Having financial knowledge and stability is key to leading a successful life. There are many different ways to make money that can be done as a side hustle and can fit better in a high school student’s schedule. One way of making money is by investing, which involves putting money into businesses so profit can eventually accumulate.

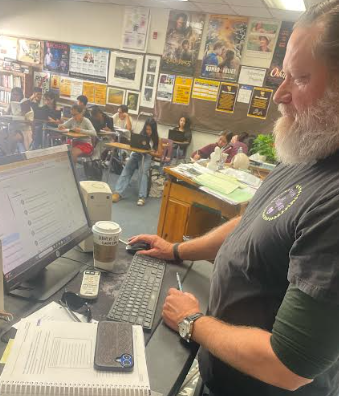

There is a new club called the Young Investors’ Society (YIS) which is dedicated to teaching students how to invest while also teaching them about financial literacy to help them prepare for future financial wellness.

This club helps students start investing with the guidance of junior Tony Hoang, the club president. He became interested in investing because of his father, who has been investing for a long time. Along with Hoang, junior and treasurer Tyler Gomez recognizes the importance of learning how to make money and putting to use those financial skills.

“A big reason of what I started this club is I noticed there’s not a lot of business finance majors around campus, there’s not a lot of opportunities for clubs… so I think this is a very good opportunity if your interested in a business major, finance, maybe accounting, and there opportunities here, for scholarships thats that YIS offers,” said Hoang.

This club is a division of The YIS, a non-profit organization that gives high school students an opportunity to learn the fundamentals of investing. It focuses on the stock market while also teaching, planning, and introducing all the fundamentals of investing. They provide investing simulations that are similar to investing in the real world to guide teens on their journey.

Although many students on campus aren’t 18 and don’t meet the required age to start investing, the option of having a custodial brokerage account is a method that can be used to invest. A custodial brokerage account is an investing account managed by parents that can later be passed down to their kids when they reach adulthood. Hoang hopes to convince parents to open a brokerage account for members when they have practiced and are ready to take the next step and start investing in the stock market.

“Custodial accounts are managed by parents, that’s the only way for a minor to invest, and we’re trying to get leads, like I’ll basically help convince your parents to start,” said Hoang.

The YIS organization offers opportunities for students such as competitions through the organization, activities, game nights, and a possible trip to New York this upcoming year. There are also opportunities to earn scholarships and free resources that include videos and tutorials on investing.

This club is open to anyone, especially students interested in business majors. It can serve as the foundation for the future and can be helpful for those wanting to start, but are unsure of how to do it.

“We’ll be there to help, guide them and as a support system as well we’re all in this together we’ll just be behind their back, if they have any questions, we’re always here to answer them,” said Gomez.

Gomez enforces the importance of starting to invest from a young age so that it’s easier to earn money quickly in adulthood. As people invest more over time, they are able to increase the amount they are investing and expand to different stocks therefore increasing the amount of profit generated.

“It’s a good skill to learn later in life, and also better to start investing when you’re younger, so you can have more assets to grow over time when you get older,” said Gomez.

A big part of investing is knowing what and how to invest. There are many risks that come from investing like high reward investments, which is investing larger amounts to profit large amounts of money, and low risk investments that produce a lower income. The club focuses on low risk, low reward investments because although it is a longer process it will be beneficial later in life, especially towards retirement.

Students also learn to use strategies involving diversified portfolios, which allows you to invest in many different stocks instead of putting all the money towards one stock and risking the outcome. Diversified stocks allow flexibility because although one stock invested might go down, investors will still have many more that may succeed and profit can still be made.

“So imagine you have, like 1000 bucks. If you put it into a diverse portfolio of like 10 stocks, if one stock goes down and other stock goes up you’re still making a profit,” said Hoang.

Although investing can be intimidating for many people, with the help of the YIS club, students can be guided towards growing or starting their investment journey. So if interested in investing, aiming to be in the financial industry, or just wanting to try something new…

“Invest in your future by joining YIS,” said Hoang.