Student debt: an endless cycle

Graduates protesting against the ongoing student debt issues.

February 24, 2023

High school seniors accepted to their dream colleges and prestigious universities are excited for the new chapter in their lives. In reality, they face short-lived happiness once they receive their tuition expenses. Council on Foreign Relations, an online publication that reports on events occurring throughout the world, spoke on these issues and reported how numbers doubled over the last two decades. As the cost of tuition continues rising, those wanting to attend college wonder if it will be possible for them.

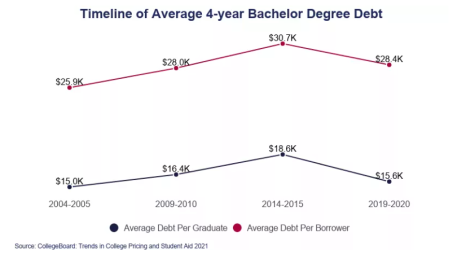

Alicia Hahn from Forbes Daily, a well-known publication, published an article “2023 Student Loan Debt Statistics: Average Student Loan Debt” that provides statistical estimates including several graphs comparing student loan debt within different years.

“The cost of college has steadily increased over the last 30 years. In that time frame, tuition costs at public four-year colleges grew from $4,160 to $10,740 and from $19,360 to $38,070 at private nonprofit institutions. Today, more than half of students leave school with debt,” said Hahn.

The financial cost of tuition fees affects high school students who work tirelessly in order to create impressive applications for colleges.

For senior Zachary Elhusseiny, attending college is a significant step toward his career. Elhusseiny hopes to major in biology in order to become a doctor by putting his education first.

“To be financially stable I would have to be cautious of my spending and save money whenever I can. I would also have to work a part-time job in order to make extra money,” said Elhusseiny.

From being the captain of the boy’s water polo team to also being a part of the Chess Club and CSF, Elhusseiny shares his thoughts on future generations attending college as inflation has been on the rise ever since the start of the pandemic.

“I think that it is more difficult for future generations to receive a college education because as tuition costs increase, many families would not be able to deal with the student debt,” said Elhusseiny.

Center for Online Education, an educational resource offering information degrees and data, published “The State of Student Debt” that provides the history timeline of student debt, from introducing student loans in the 1840s, to reaching a ten billion dollar federal student loan fee in the late 1980s. The article also analyzed the tuition cost increase for years.

Link Crew and O-Ambassador member Bliss Aguilar knows what to expect as she continues her journey to become an English teacher.

“I’ve always been on top of my education and pursuing a good career, but right away hearing you will be in debt is not a good mindset to go into college with,” said Aguilar.

Aguilar has been accepted to four colleges, San Francisco State being her dream school.

Free Application for Federal Student Aid, (FASFA), is a form completed by students in the United States to determine their eligibility for student financial aid.

According to FASFA, “completing, and submitting the FASFA is free and easier than ever, and it gives you access to the largest source of financial aid to pay for college or career school.”

“I’ve applied for FASFA and received my San Francisco State financial aid which will cover around five thousand dollars per semester which is helpful,” said Aguilar.

The Best Schools, a website that provides rankings of colleges and universities, noted how the rise of inflation results in high demand and deducted state funding, leading to the rising cost of tuition fees.

Earnest.com released a blog on thoughts on repaying and refinancing student loans. Their motive is to refinancing student loans with low rates.With administrative staff payments, construction, facility, and alongside state funding cuts can rack up to high tuition fees on students.

“The numbers of students that have the opportunity we have are going to decrease because it is expensive to get a good education. The better the school, the more money it is,” said Aguilar.

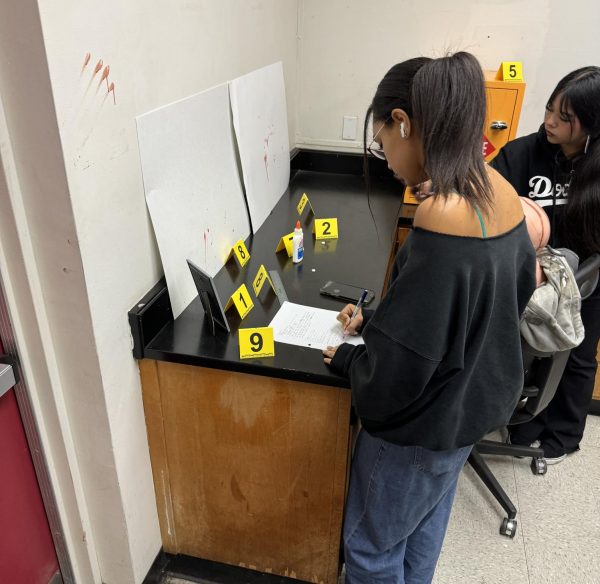

Photo Credit: Forbes Daily

Uopeople.edu publication, on the other hand, focuses on educating not only students, but younger generations by giving another perspective on student loans around the world.

Editors from Uopeople.edu published “Student Loan Debt: A Must Read Guide for Students” to include reports on five important steps in order to avoid falling into student debt

“Repayments are only mandated upon graduation. The government will pay the interest while you are in school. The amount you can borrow depends on what year of school you are in, which increases each year of your undergraduate studies.”

By investing funds in these colleges and universities, increasing rates has important significance. University of the People news publication compares tuition costs to one another comparing and contrasting those costs.

Although the government provides access to financial aid and other resources to help with college expenses, making the correct financial decision and setting budgets could save years of stress.

According to Whitehouse.gov, The White House released “Fact Sheet: The Biden-Harris Administration’s Plan for Student Debt Relief Could Benefit Tens of Millions of Borrowers in All Fifty States” stating a new plan for those who continue struggling with student debt.

“The Biden-Harris Administration expects that over 40 million borrowers are eligible for its student debt relief plan, and nearly 20 million borrowers could see their entire remaining balance discharged.”

The debt relief plans are beneficial, but have not solved the endless cycle of high tuition students face to this day.